The world is going cashless. Digital payments are growing increasingly popular. Alternative payment methods offer convenience and meet evolving guest expectations.

But, without the proper payment automation solution, its high volume can spell major hotel operational issues. Hotel payment processing involves complexities that require a robust payment solution to streamline transactions and enhance the guest experience.

Instead of consolidating payments or keying card information into terminals, automation is the smart way to handle digital transactions — and in Clock’s hotel solution, it’s easy to do.

This article will show two popular payment automation cases in Clock PMS+: charging cards to flexible payment policies and Expedia cards on arrival day.

The manual hotel payment processing problem

With digital and mobile-friendly payment options like Apple Pay and Google Pay improving the booking experience, aligning your hotel with modern e-commerce standards is important.

Without payment automation, hotels rely on insecure guest communication and extensive manual work, which puts the hotel and cardholder at risk. Securely collecting credit card details is crucial to guarantee bookings and protect sensitive information.

Payment security is essential, requiring compliance with rigorous standards like PCI-DSS and GDPR to safeguard guest data.

The process usually goes like this:

- Get card details from insecure channels (like phone, email, or OTA extranets)

- Process the details in physical POS terminals

This process is also true for OTA virtual cards.

Your hotel receives the virtual card details, including the 16-digit number, expiry date, and security code, and gets it loaded with the booking amount minus commission.

Depending on the OTA, you have different time frames for charging it. For example, Expedia cards only allow you to charge it on arrival day and onwards.

That means someone from the front desk staff must manually key the card details in their POS terminal to charge it on arrival day.

Without payment automation, this process is time-consuming and prone to incorrect charges. And for personal cards, there’s no way to know if the details are real until you charge them.

Mistakes in data entry or insufficient funds need further communication with guests, resulting in wasted staff time and resources.

Waiting for guest arrivals to process payments can lead to no-shows or insufficient funds, risking lost cancellation or no-show fees.

Outsourcing payment processing to OTAs comes with a fee, and effectively handling OTA virtual cards still needs payment automation solutions to avoid manual handling.

Let’s see how you can solve all these problems with automated payments in Clock.

Use case: Flexible guarantee policies with your guest's preferred payment method

Many hotels have flexible guarantee policies, making it a popular use case for managing online payments in Clock. For example, the hotel policy may ask for a 50% payment upfront and the remaining 50% two days before arrival.

Many hotels have flexible guarantee policies, making it a popular use case for managing online payments in Clock. For example, the hotel policy may ask for a 50% payment upfront and the remaining 50% two days before arrival.

Collecting all remaining payments to your hotel’s policy is easy in Clock's property management system (PMS) with a Payment Autopilot task. Additionally, the functionality of sending payment requests allows hoteliers to automate or manually request payments from guests easily, enhancing cash flow management and providing a seamless online payment experience.

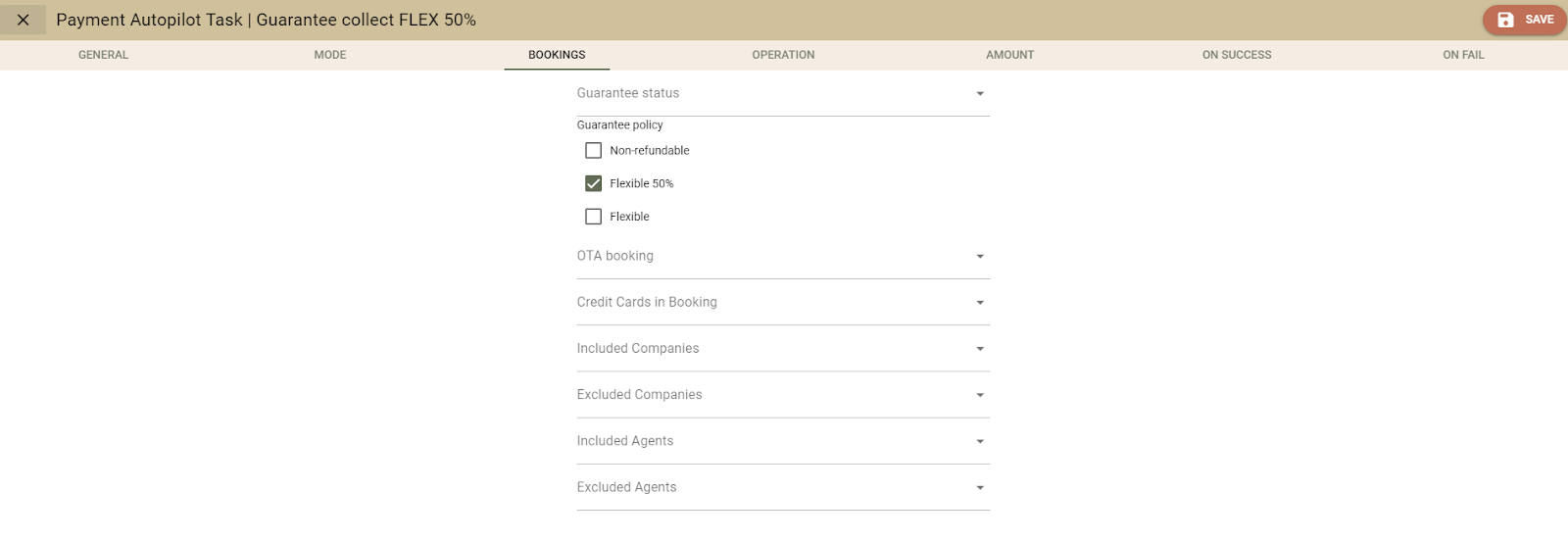

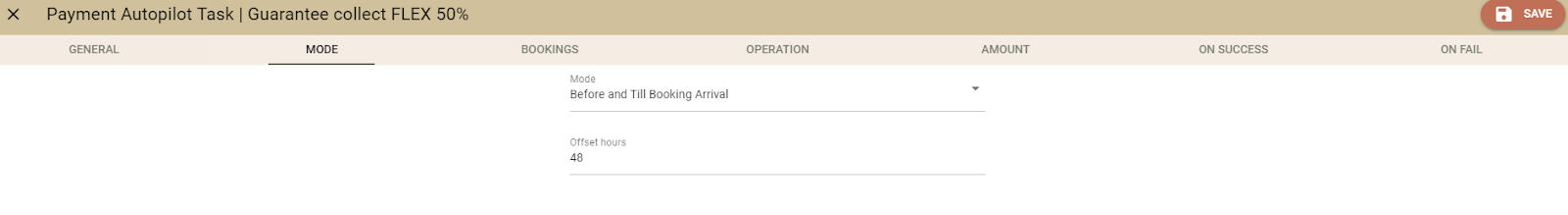

Because we want the charge two days before arrival, we chose our Flexible 50% Guarantee policy and started the task 48 hours before arrival.

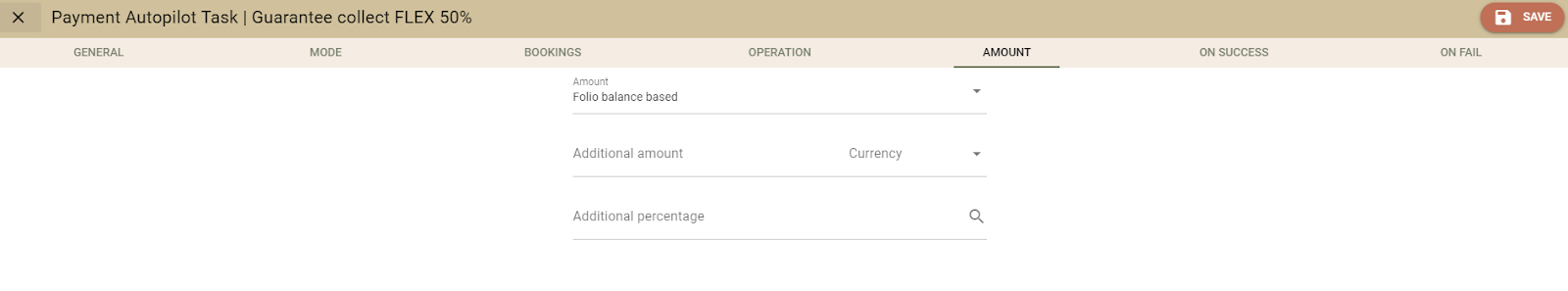

Specify the charged amount to be the remaining folio balance.

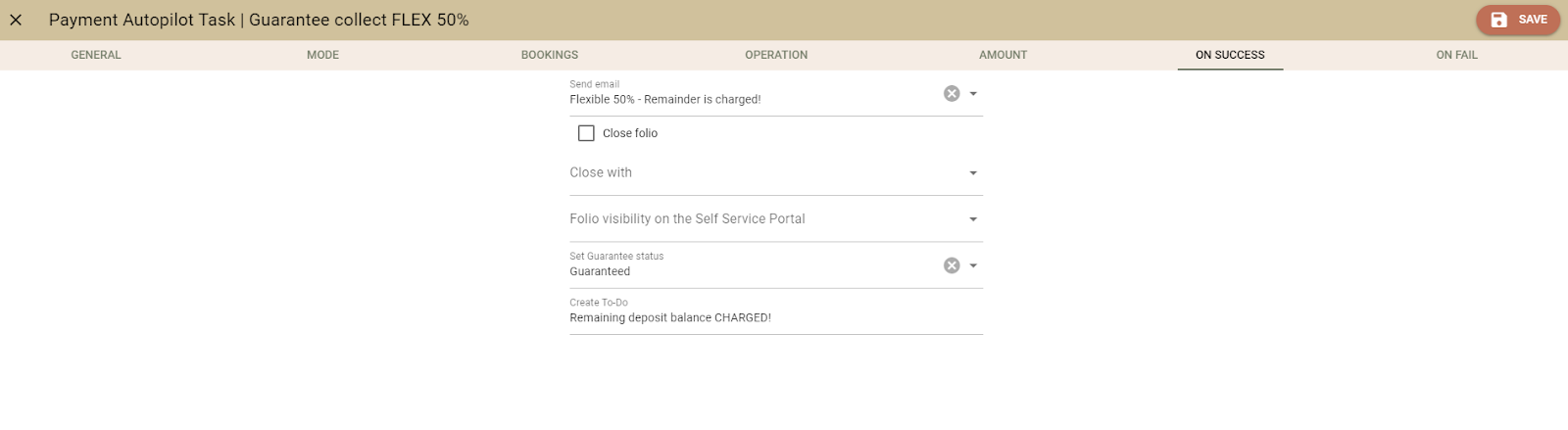

Choose what happens on success or failure.

In this example, we created an email in the Guest Mailer confirming that we took the remaining 50% upon success, as mentioned in our guarantee policy.

Depending on local laws and tax rules, you can close the folio and issue receipts immediately after payment.

Usually, the folio remains open so the guest can add extra services upon arrival. The guest can then pay the remaining folio on one bill on departure.

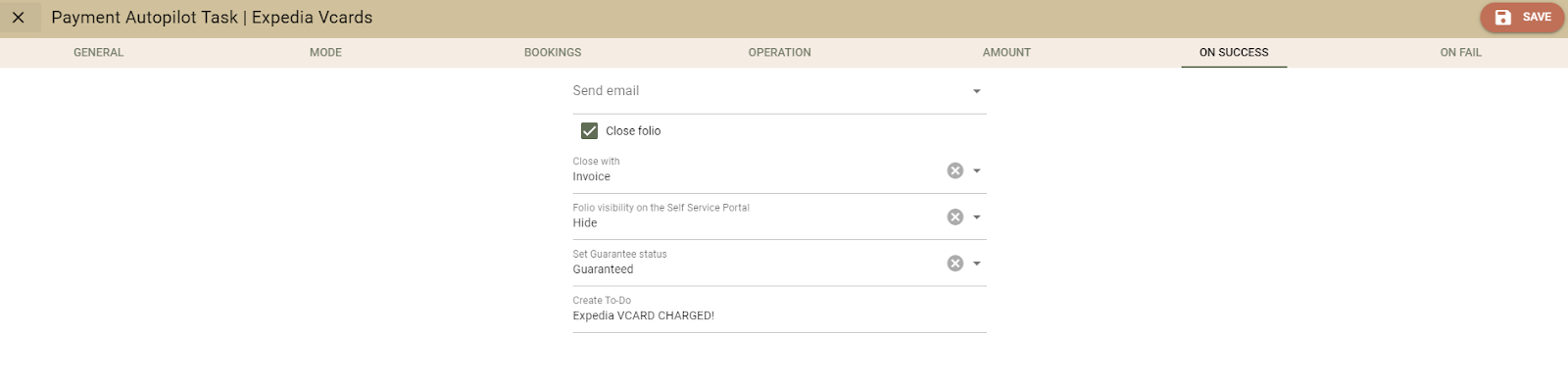

You can also create a to-do for staff, letting them know the money is in.

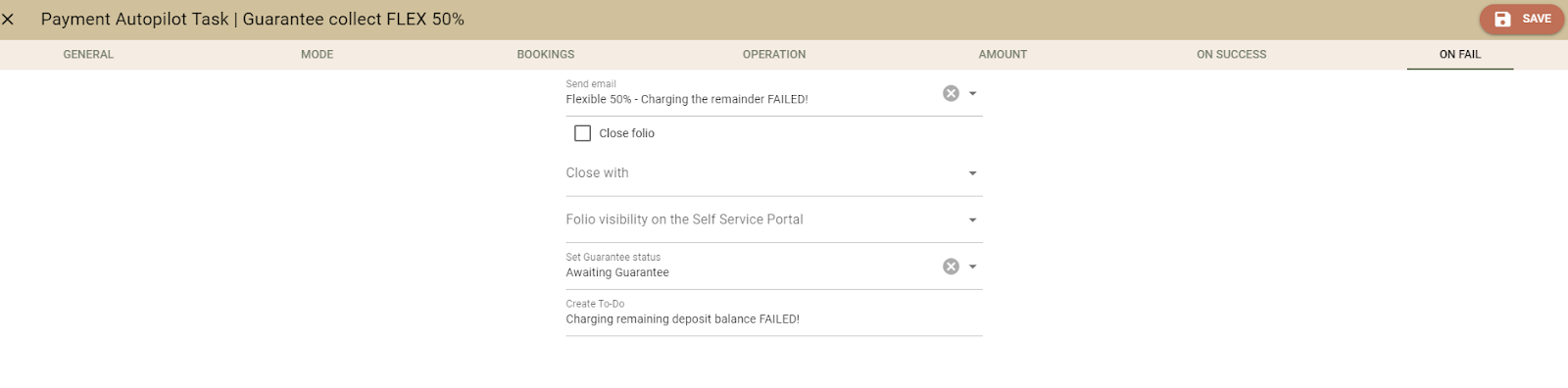

If the transaction fails, you can send a different email to the guest.

Ask them to add funds to the card or go to Clock’s online check-in to complete the payment.

You can also create a to-do to inform staff about missing payments.

Automating tasks to your hotel’s policies is easy in Clock.

It allows you to collect deposits or fees at booking and automate charging of the remaining balance before guest arrival to your hotel policies.

It allows you to secure revenue in advance, especially during peak seasons, minimise manual errors, save time, and mitigate risks associated with incorrect payments or no-shows.

Hotels can improve operational efficiency, reduce risks, and secure and efficiently handle guest payments.

Use case: Expedia Virtual Credit Cards

Instead of manually charging Expedia virtual cards on arrival day in POS terminals, you can optimize the payment process through automation in simple steps and charge all OTA cards automatically.

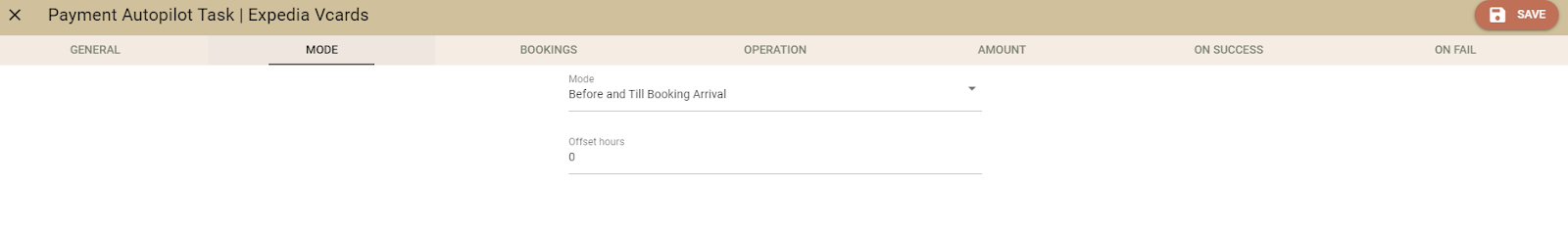

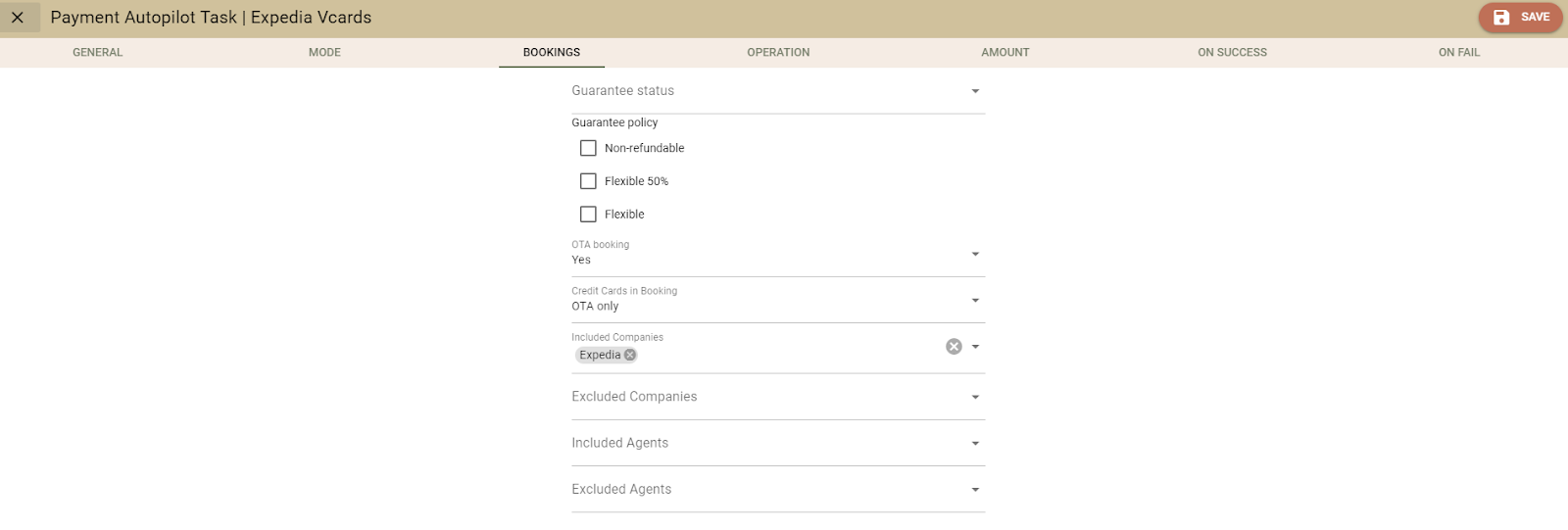

Start the Payment Autopilot on the arrival date. Select OTA booking and that the task is only for bookings with OTA (virtual) cards.

Choose Expedia from the OTA list.

Upon success, the folio will close, and an invoice will be issued because this transaction is between the hotel and Expedia.

Hide the folio from the self-service portal.

That way, the guest will not see the folio with the fees between you and Expedia.

Start the Payment Autopilot task.

Now, your hotel will automatically charge Expedia virtual cards on the arrival day automatically — without forgotten payments or missed revenue.

Summary

As more and more countries focus on online payments and alternative payment methods like Apple Pay and Google Pay, your operational ability to handle these transactions becomes increasingly important. Utilizing various payment providers can simplify cash flow management by offering features such as easy reconciliation, automated payments, and industry-standard security.

Smooth payment processing is crucial in the hospitality industry. Automated payment tasks, daily payouts, and secure transactions enhance cash flow management and improve the guest experience.

By automating payment tasks like flexible guarantee policies and charging Expedia virtual cards, you and your staff can focus where it matters – on delighting guests. While the two use cases presented in this article are popular with our customers, they’re only a glimpse of what you can automate.

For example, without lifting a finger, you can release pre-authorizations that will not be used (like security deposits) immediately after checkout for top guest satisfaction. With excellent support, you can easily set up your hotel payment processing in Clock PMS+. A few clicks can make a large part of your hotel's financial operations run itself.

Discover many more use cases for payment processing automation — book your demo today.